Gusto paycheck calculator

This Louisiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Compare Gusto Payroll With Other Payroll Services Gusto

Switch to California hourly calculator.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. Iowa Salary Paycheck Calculator.

Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator. This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Iowa hourly calculator. The COVID-19 pandemic continues to present small businesses with new challenges and as a result the government has stepped in to offer financial relief resources.

Switch to Texas hourly calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Hourly Paycheck and Payroll Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your South Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free South Carolina paycheck calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Pennsylvania salary calculator. This Pennsylvania hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Switch to Arizona hourly calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. This Ohio hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Nebraska Salary Paycheck Calculator. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas. This Wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Florida. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. This Nevada hourly paycheck calculator is perfect for those who are paid on an hourly basis.

California Salary Paycheck Calculator. Key among these is the Employee Retention Credit ERC which was established in the CARES Act. Switch to Florida hourly calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Missouri salary calculator. Switch to Wisconsin salary calculator.

Switch to North Carolina hourly calculator. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator. Switch to Nevada salary calculator.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. Since ERC was initially established it has undergone a number of changes and expansions. Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator.

ASCII characters only characters found on a standard US keyboard. 6 to 30 characters long. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Switch to South Carolina hourly calculator. Must contain at least 4 different symbols. Switch to Kansas salary calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Louisiana salary calculator. Switch to Nebraska hourly calculator.

South Carolina Salary Paycheck Calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

This Kansas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. North Carolina Salary Paycheck Calculator.

Switch to Maryland salary calculator. Need help calculating paychecks. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Gusto Payroll Hr Payroll Benefits And Hr Built For Small Business Shopify App Store

Gusto Review Pcmag

Compare Gusto Payroll With Other Payroll Services Gusto

Gusto Vs Square Payroll Compare Pricing Product Features And More Gusto

Online Payroll Services And Software Gusto

Switch Your Payroll Provider To Gusto S People Platform Gusto

Gusto Payroll Hr Payroll Benefits And Hr Built For Small Business Shopify App Store

Gusto Hr Software Review 2022 Businessnewsdaily Com

What Are Employer Taxes And Employee Taxes Gusto

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

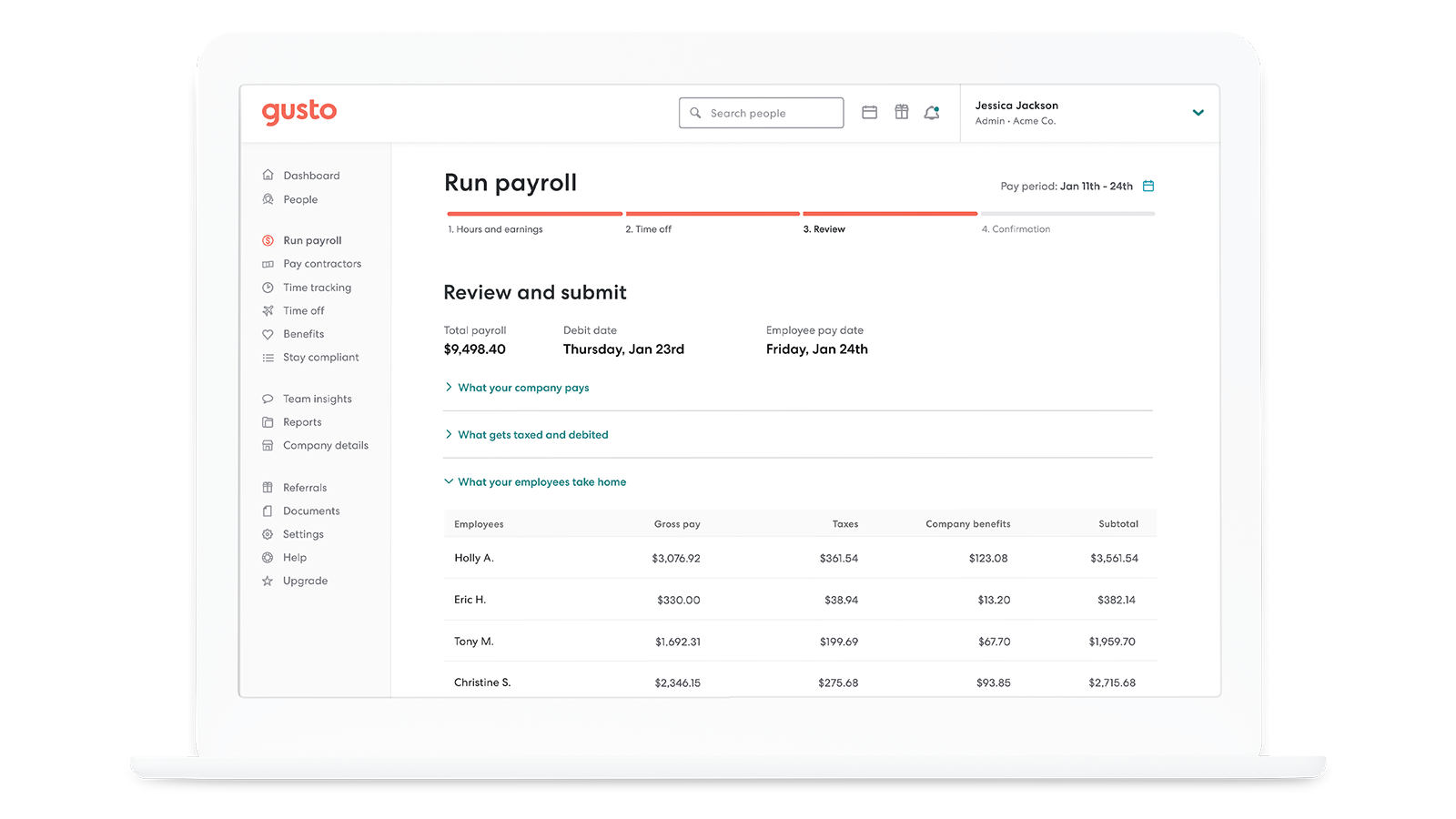

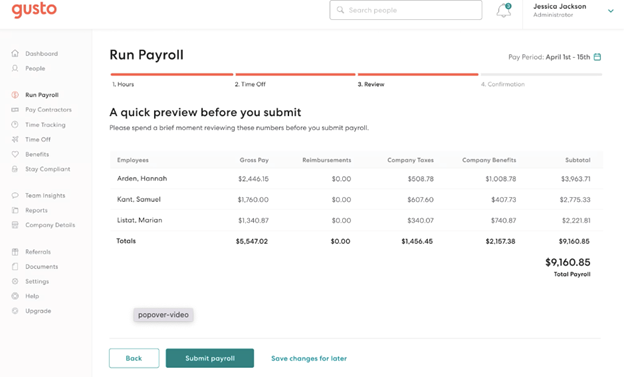

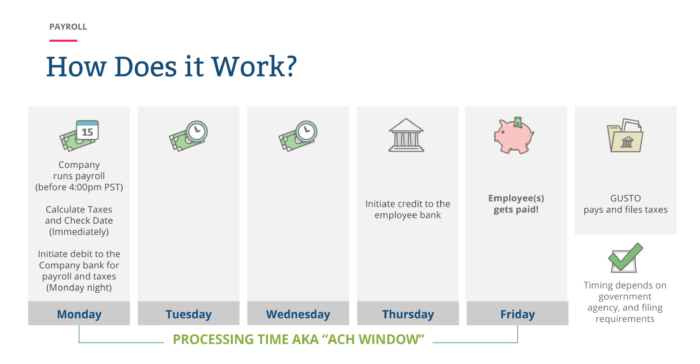

Payroll Tax Calculator For Employers Gusto

What Is Gusto Payroll And How Can Business Owners Benefit From It Bookkeeper360

Gusto Review Pcmag

Gusto Review Pcmag

Free Payroll And Hr Resources And Tools Gusto

Payroll Tax Calculator For Employers Gusto